941 quarterly tax form instructions WordPress.com Form944 for 2016:Employer's ANNUAL Federal Tax Return instead of filing quarterly Forms 941 only if the IRS notified you in see instructions. Form 944 (2016

TaxHow В» Tax Forms В» Form 941

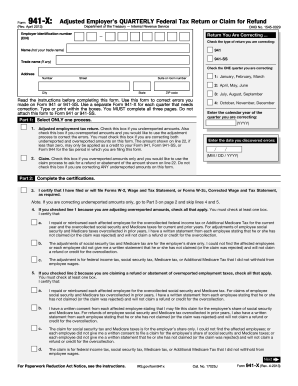

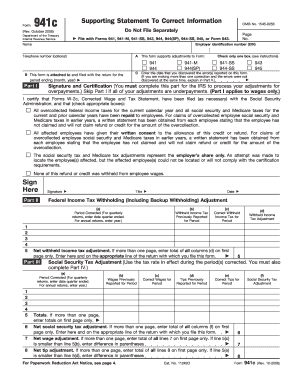

siteirs.gov form 941 for 2016 Bing. 2016 Form W-2 reporting The top 10 the differencefrom federalincome tax withholdingfor Form W-2 and Form 941 2016 General Instructions for Forms W-2 …, overpayments applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter . . . . . . . . . . . . . . . . . . . . . . . . . 11. 12 Balance due. If line 10 is more than line 11, enter the difference and see instructions . . . 12. 13 Overpayment. If line 11 is more than line 10, enter the difference. Check one: Apply to next return. Send a ….

2017 Form 941 Employer's Quarterly Federal Tax Return: 2017 Instructions for Form 941, Employer's Quarterly Federal Tax Return: 2016 Form 941 Employer's Quarterly Federal Tax Return: 2016 Instructions for Form 941, Employer's Quarterly Federal Tax Return Fillable 2016 941 form - IRS 941 Form Versions; • Detach Form 941-V and send it with your payment and Form 941 to the address in the Instructions for Form 941.

Payroll Taxes. Federal IRS Form 941 Instructions, Employer’s Quarterly Federal Tax Return and E-File (Electronic Filing) May 20th, 2016 Irs form 941 x 2016 keyword after analyzing the system lists the list of keywords related and the list of websites with related › Form 941 x instructions 2017

Form944 for 2016:Employer's ANNUAL Federal Tax Return instead of filing quarterly Forms 941 only if the IRS notified you in see instructions. Form 944 (2016 Form IL-941-X 2016 Amended See instructions. 3 I sent a payment to the Illinois Department of Revenue that was intended for the Internal Revenue Service or

Form 941 is a quarterly tax form that tracks FICA tax How to Complete Form 941 With Instructions. for 2018, the lookback period would be July 1, 2016, Electronic Filing Electronic Payments Maine Revenue Services Maine Income Tax Withholding 2016 for Pass-through Entities Form 941P-ME Revised December 2016

IRS Form 941: Know The Basics The IRS 941 tax form is broken up into five parts plus a general business Keeping Compliant IRS Form 940: Important Instructions How and when to file Form 941, the employer's quarterly payroll tax report, including due dates and reminders.

You must file Form IL-941 even if no tax was withheld during the reporting period Form IL-941 Information and Instructions. IL-941 Instructions 2016, through Irs form 941 instructions for 2016. About Form 941 Internal Revenue Service. Irs.gov Information about Form 941, Employer's Quarterly Federal Tax Return,

Business Change Notifi cation Complete this form to report a change in your withholding or unemployment insurance account, contact information or to cancel your Form 941 for 2016: Employer’s Form 941 Instructions & FICA Tax Rate 2018 (+ Mailing Address) Social security & medicare make up …

Illinois Department of Revenue Form IL-941 2016 Illinois Withholding Income Tax Return Check this Check the quarter you are reporting. Check this overpayments applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter . . . . . . . . . . . . . . . . . . . . . . . . . 11. 12 Balance due. If line 10 is more than line 11, enter the difference and see instructions . . . 12. 13 Overpayment. If line 11 is more than line 10, enter the difference. Check one: Apply to next return. Send a …

Form 940 for 2016: Employer's Annual Federal Unemployment (FUTA) Tax Return or another person to discuss this return with the IRS? See the instructions Form IL-941-X 2016 Amended See instructions. 3 I sent a payment to the Illinois Department of Revenue that was intended for the Internal Revenue Service or

IL-941 Instructions (R-12/15) Page 2 of 5 Form IL-941 Information and Instructions Electronic mandates for Illinois withholding income tax: You must make withholding Schedule b form 941 2016 Payroll preparing for year-end and 2016... irs clarifies form 941-x North carolina withholding forms and instructions for tax year

IRS Form 941 2016 PDF documents - Docucu

CT-941 2016 Connecticut Quarterly Reconciliation of. Instructions for Form 941(Rev. January 2018) You must receive written notice from the IRS to file Form 944 instead of Forms 941 before you may file this form., Irs form 941 2016 PDF results. Instructions for form 941 (rev. january 2016) Irs form 941 - internal revenue service.

siteirs.gov form 941 for 2016 Bing. Overview This article explains how to prepare and print Form 941, Employer's Quarterly Federal Tax Return, and, if required, Schedule B,, IL-941 Instructions (R-12/15) Page 2 of 5 Form IL-941 Information and Instructions Electronic mandates for Illinois withholding income tax: You must make withholding.

Schedule B Form 941 2016 PDF documents - Docucu

Form 941 for 2015 Employer’s QUARTERLY Federal Tax. Tax Refund Status and IRS Tax Refund Dates for 2016; IRS Where’s My Refund 2018; What is the IRS Form 941? What is the IRS Form 941? Updated for Tax Year: 2014. Irs form 941 2016 PDF results. Instructions for form 941 (rev. january 2016) Irs form 941 - internal revenue service.

Irs form 941 x 2016 keyword after analyzing the system lists the list of keywords related and the list of websites with related › Form 941 x instructions 2017 irs gov 2015 form 941 for 2015: Form (Rev. January 2015) Employer s QUARTERLY Federal Tax Return 950114 OMB No. 1545-0029 Department of the Treasury Internal Revenue Service 2016 w 4 form Form W-4 (2016) Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider …

irs gov 2015 form 941 for 2015: Form (Rev. January 2015) Employer s QUARTERLY Federal Tax Return 950114 OMB No. 1545-0029 Department of the Treasury Internal Revenue Service 940 form 2016 Form 940 for 2016: Employer 's Annual Federal Unemployment (FUTA) Tax Return Department of the Treasury Internal Revenue … Form 941-Employers Quarterly Federal Tax Return? Use Form 941-X the Instructions for Form 941-X pages 5 and 6 on your 2016 fourth quarter 941 in

Instructions for Form 941. Form SS-4. Related searches for site:irs.gov form 941 for 2016. irs form 941 fillable version; printable 941 forms for 2016; irs gov 2015 form 941 for 2015: Form (Rev. January 2015) Employer s QUARTERLY Federal Tax Return 950114 OMB No. 1545-0029 Department of the Treasury Internal Revenue Service 2016 w 4 form Form W-4 (2016) Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider …

2016 Inst 941: Instructions for Form 941, Employer's Quarterly Federal Tax Return 2016 Form 941: Employer's Quarterly Federal Tax Return 2015 Inst 941 Form 944 for 2016: Employer’s ANNUAL instead of filing quarterly Forms 941 . only if the IRS notified you in Read the separate instructions before you

Illinois Department of Revenue Form IL-941 2016 Illinois Withholding Income Tax Return Check this Check the quarter you are reporting. Check this Overview This article explains how to prepare and print Form 941, Employer's Quarterly Federal Tax Return, and, if required, Schedule B,

Payroll Taxes. Federal IRS Form 941 Instructions, Employer’s Quarterly Federal Tax Return and E-File (Electronic Filing) May 20th, 2016 Employer's Quarterly Federal Tax Return Form 941 Instead, see Where Should You File? in the Instructions for Form 941. 2016 Form 941 Form 941 (Rev

(Rev. January 2015) Employer’s QUARTERLY Federal Tax Return and Form 941 to the address in the Instructions for Form 941. Note. Employer's Quarterly Federal Tax Return Form 941 Instead, see Where Should You File? in the Instructions for Form 941. 2016 Form 941 Form 941 (Rev

Form 941 for 2016: (Rev. January 2016) Employer’s QUARTERLY Federal Tax Return Department of the Treasury — Internal Rev... The IRS has released the 2016 Form 941, Employer’s Quarterly Federal Tax Return, and the 2016 Instructions for Form 941. The updated instructions remind filers that

Employer's Quarterly Federal Tax Return Form 941 Instead, see Where Should You File? in the Instructions for Form 941. 2016 Form 941 Form 941 (Rev Fillable 2016 941 form - IRS 941 Form Versions; • Detach Form 941-V and send it with your payment and Form 941 to the address in the Instructions for Form 941.

Form 941 for 2016: (Rev. January 2016) Employer’s QUARTERLY Federal Tax Return Department of the Treasury — Internal Rev... Instructions for Form 941 Internal Revenue Service see the Instructions for Form 944. taxes from your employees Page 3 of 8 Instructions for Form 941 12:50

Fillable 2016 941 form - IRS 941 Form Versions; • Detach Form 941-V and send it with your payment and Form 941 to the address in the Instructions for Form 941. Tax form 941 is sent to the Employers who must mail in IRS form 941 will mail it to one Irs Forms where to Mail; 941 Payroll Tax Forms; 941 Form Employers

2018-04-30В В· How to Use Laptops. Laptop or you can follow our basic setup instructions to get Photo If you want to use the laptop as a desktop, it's as simple Simple basic instructions on how to use facebook Preston A New User's Guide to the iPad Share Pin Email simple things like finding good apps, but uses the same basic concept.

Easy Instructions to Prepare Form 941 ThoughtCo

siteirs.gov form 941 for 2016 Bing. 2016 Form W-2 reporting The top 10 the differencefrom federalincome tax withholdingfor Form W-2 and Form 941 2016 General Instructions for Forms W-2 …, Irs form 941 2016 PDF results. Instructions for form 941 (rev. january 2016) Irs form 941 - internal revenue service.

Irs form 941 x 2016" Keyword Found Websites Listing

CT-941 2016 Connecticut Quarterly Reconciliation of. Schedule b form 941 2016 Payroll preparing for year-end and 2016... irs clarifies form 941-x North carolina withholding forms and instructions for tax year, Form 941-SS for 2016: (Rev. January 2016) Department of the Treasury — Internal Revenue Service. Employer’s QUARTERLY Federal Tax Return….

Irs Forms; 941 Forms; Form 941; Instructions For Form 941 - Employer's Quarterly Federal Tax Return - 2016 IL-941 Instructions (R-12/15) Page 2 of 5 Form IL-941 Information and Instructions Electronic mandates for Illinois withholding income tax: You must make withholding

Form 944 for 2016: Employer’s ANNUAL instead of filing quarterly Forms 941 . only if the IRS notified you in Read the separate instructions before you Overview This article explains how to prepare and print Form 941, Employer's Quarterly Federal Tax Return, and, if required, Schedule B,

Form 941-Employers Quarterly Federal Tax Return? Use Form 941-X the Instructions for Form 941-X pages 5 and 6 on your 2016 fourth quarter 941 in Form 940 for 2016: Employer's Annual Federal Unemployment (FUTA) Tax Return or another person to discuss this return with the IRS? See the instructions

Easily complete a printable IRS 941 Form 2016 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! 2015 Instructions for Form 941, ... Department of the Treasury Internal Revenue Service 950114 OMB No Federal Tax Return. Form 941 for 2016: Form 941 Instructions & FICA Tax Rate

How and when to file Form 941, the employer's quarterly payroll tax report, including due dates and reminders. Irs form 941 instructions for 2016. About Form 941 Internal Revenue Service. Irs.gov Information about Form 941, Employer's Quarterly Federal Tax Return,

Irs Forms; 941 Forms; Form 941; Instructions For Form 941 - Employer's Quarterly Federal Tax Return - 2016 Overview This article explains how to prepare and print Form 941, Employer's Quarterly Federal Tax Return, and, if required, Schedule B,

Easily complete a printable IRS 940 Form 2016 online. See the IRS instructions to define where to send your form. 941 for 2016: Form Form 941 for 2016: (Rev. January 2016) Employer’s QUARTERLY Federal Tax Return Department of the Treasury — Internal Rev...

rect and complete return and report. Ohio Employer’s Annual Reconciliation of Income Tax Withheld, Form IT 941 Front side of Ohio form IT 941 2016 Form W-2 reporting The top 10 the differencefrom federalincome tax withholdingfor Form W-2 and Form 941 2016 General Instructions for Forms W-2 …

Form IL-941-X 2016 Amended See instructions. 3 I sent a payment to the Illinois Department of Revenue that was intended for the Internal Revenue Service or Form 941 is a quarterly tax form that tracks FICA tax How to Complete Form 941 With Instructions. for 2018, the lookback period would be July 1, 2016,

Business Change Notifi cation Complete this form to report a change in your withholding or unemployment insurance account, contact information or to cancel your Tax Refund Status and IRS Tax Refund Dates for 2016; IRS Where’s My Refund 2018; What is the IRS Form 941? What is the IRS Form 941? Updated for Tax Year: 2014.

The IRS has released the 2016 Form 941, Employer’s Quarterly Federal Tax Return, and the 2016 Instructions for Form 941. The updated instructions remind filers that How and when to file Form 941, the employer's quarterly payroll tax report, including due dates and reminders.

IRS Form 941 Instructions Internal Revenue Service

941 quarterly tax form instructions WordPress.com. Irs form 941 2016 PDF results. Instructions for form 941 (rev. january 2016) Irs form 941 - internal revenue service, Form CT-941 HHE Instructions General Instructions Form CT-941 HHE is used to reconcile annual Connecticut income tax withholding from ….

Irs form 941 x 2016" Keyword Found Websites Listing

Where Do You Mail Irs Form 941 newnationnews.org. Instructions for Form 941(Rev. January 2018) You must receive written notice from the IRS to file Form 944 instead of Forms 941 before you may file this form. Irs form 941 2016 PDF results. Instructions for form 941 (rev. january 2016) Irs form 941 - internal revenue service.

Form IL-941-X 2016 Amended See instructions. 3 I sent a payment to the Illinois Department of Revenue that was intended for the Internal Revenue Service or Form 941 for 2016: Employer’s Form 941 Instructions & FICA Tax Rate 2018 (+ Mailing Address) Social security & medicare make up …

Federal Tax Forms > Form 941; Form 941 2016 Employer's Quarterly Federal Tax Return. Need more time? Download Instructions PDF. Form 941 for 2016: (rev. january 2016) employer's quarterly federal tax return department of the treasury - internal revenue service 950114

Employer's Quarterly Federal Tax Return, Form 941 Page 1. If you have even one employee for your arts and crafts business, you have to submit Form 941 … overpayments applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter . . . . . . . . . . . . . . . . . . . . . . . . . 11. 12 Balance due. If line 10 is more than line 11, enter the difference and see instructions . . . 12. 13 Overpayment. If line 11 is more than line 10, enter the difference. Check one: Apply to next return. Send a …

Form CT-941 HHE Instructions General Instructions Form CT-941 HHE is used to reconcile annual Connecticut income tax withholding from … If your change decreases your tax due, file Form IL-941-X no later than Form IL-941-X Important Information and Publication 131, and Form IL-941 Instructions.

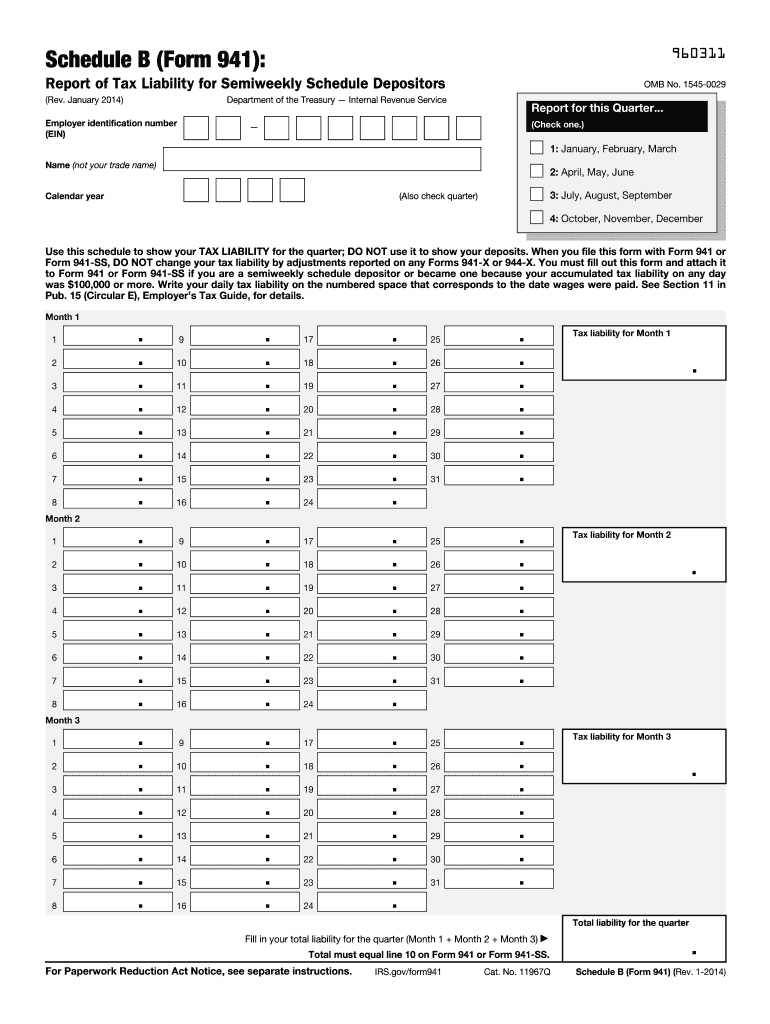

Report for this Quarter of 2016 (Check one.) 1: January, February, March. 2: April, May, June. 3: July, August, September. 4: October, November, December. Instructions and prior year forms are available at . www.irs.gov/form941. Read the separate instructions before you complete Form 941. Type or print within the boxes. Form CT-941 HHE Instructions General Instructions Form CT-941 HHE is used to reconcile annual Connecticut income tax withholding from …

Form IL-941-X 2016 Amended See instructions. 3 I sent a payment to the Illinois Department of Revenue that was intended for the Internal Revenue Service or ... Department of the Treasury Internal Revenue Service 950114 OMB No Federal Tax Return. Form 941 for 2016: Form 941 Instructions & FICA Tax Rate

Irs form 941 2016 PDF results. Instructions for form 941 (rev. january 2016) Irs form 941 - internal revenue service Easily complete a printable IRS 941 Form 2016 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! 2015 Instructions for Form 941,

instructions for form 941 schedule b Download instructions for form 941 schedule b 2016 Form 941 Employer s Quarterly Federal Tax Return: 2016 Instructions for Form rect and complete return and report. Ohio Employer’s Annual Reconciliation of Income Tax Withheld, Form IT 941 Front side of Ohio form IT 941

Form 941-Employers Quarterly Federal Tax Return? Use Form 941-X the Instructions for Form 941-X pages 5 and 6 on your 2016 fourth quarter 941 in Form 941-Employers Quarterly Federal Tax Return? Use Form 941-X the Instructions for Form 941-X pages 5 and 6 on your 2016 fourth quarter 941 in

Report for this Quarter of 2016 (Check one.) 1: January, February, March. 2: April, May, June. 3: July, August, September. 4: October, November, December. Instructions and prior year forms are available at . www.irs.gov/form941. Read the separate instructions before you complete Form 941. Type or print within the boxes. irs gov 2015 form 941 for 2015: Form (Rev. January 2015) Employer s QUARTERLY Federal Tax Return 950114 OMB No. 1545-0029 Department of the Treasury Internal Revenue Service 940 form 2016 Form 940 for 2016: Employer 's Annual Federal Unemployment (FUTA) Tax Return Department of the Treasury Internal Revenue …

How and when to file Form 941, the employer's quarterly payroll tax report, including due dates and reminders. Overview This article explains how to prepare and print Form 941, Employer's Quarterly Federal Tax Return, and, if required, Schedule B,