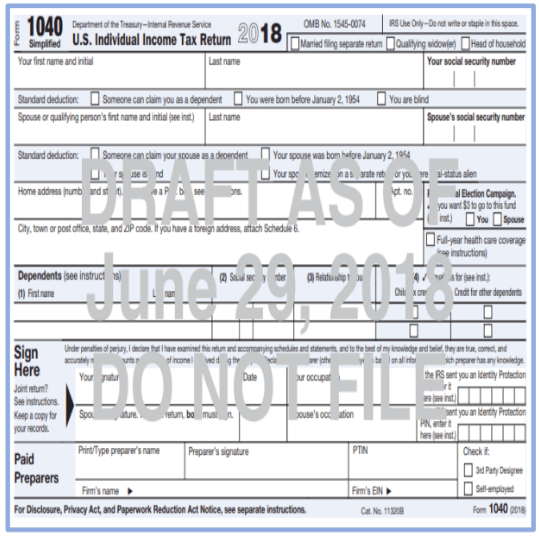

2014 tax forms 1040 instructions St. Gregor

2014 Schedule M IL-1040 Instructions Illinois 2014 1040 ez Form. 108 likes. The 1040 EZ Form for 2014 is for single and joint tax fillers with no dependents who, per their very simple tax situation,...

2014 Form IL-1040 Instructions revenue.state.il.us

2014 Tax Forms and Instructions California Department of. 2014 1040 ez Form. 108 likes. The 1040 EZ Form for 2014 is for single and joint tax fillers with no dependents who, per their very simple tax situation,..., 2014 personal income tax forms; (Instructions) Resident Income Tax Return Underpayment of Estimated Income Tax By Individuals and Fiduciaries for tax year 2014:.

Did you make any payments in 2014 that would require you to file Form(s) 1099 (see instructions) (Form 1040) 2014. Schedule F 2014 Schedule F (Form 1040) Author: Connecticut Resident Income Tax Return 2014 CT-1040 2014 Form CT-1040 use tax for online or other purchases where you paid no sales tax? See instructions,

Rev 5 10/2014. 2014 NJ-1040 . Income Tax Resident Form. For tax year Jan. - Dec., 2014 . or other tax year beginning: Month / See Instructions. FILING STATUS. 2014 Individual Income Tax Forms Nonresident and Part-year Resident Income Tax Return Instructions Fill-In Form: Schedule I: Adjustments to Convert 2014

41-002a (02/17/15) 2014 Iowa Income Tax Information Additional Expanded Instructions are available online at https://tax.iowa.gov FILE ELECTRONICALLY FOR A FASTER REFUND The instructions booklet for Form 1040 is 104 pages as of 2014. Initially, the IRS mailed tax booklets (Form 1040, instructions, and most common attachments)

2015-03-24 · 1040 tax forms 20141040 tax forms 2014 form 1040 2014 tax 1040 2014 tax 1040 form 2014 tax form 1040 2014 tax form 1040 instructions 2014 tax forms 1040 federal 1040 form 1040 form 2014 1040 tax form form 1040 forms … Forms and Instructions (PDF Tax Return 0817 09/16/2017 Inst 706: Instructions for Form 706, United States Estate (and Generation -Skipping Transfer

2014 form cf-1040 individual common forms and 2014 cf-1040 individual common city income tax form instructions for software companies NJ-1040New Jersey Resident Return 2014 • Form ST-18 Use Tax Return. Look for “New for 2014” throughout the instructions for other changes.

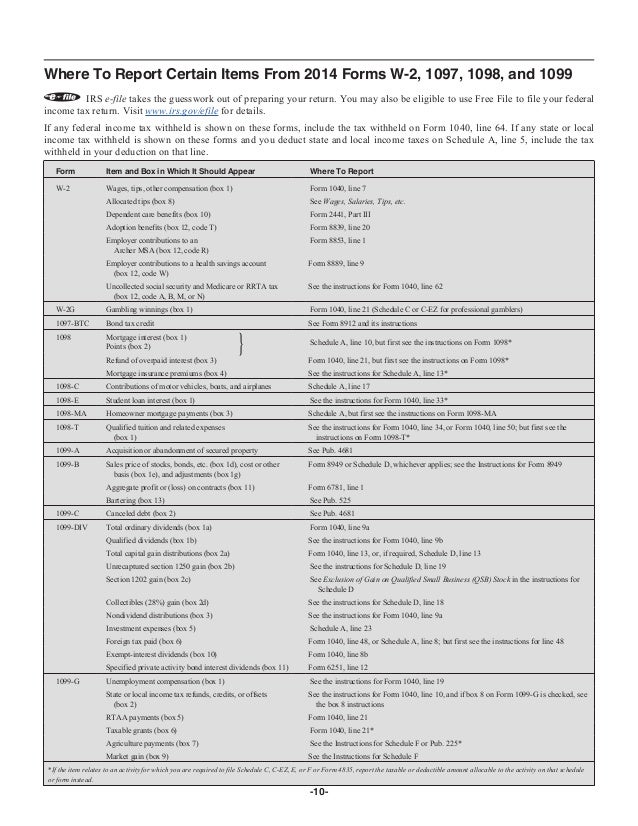

See or an Archer MSA. See the Instructions for Form 8889 for HSAs or the Instructions for Form 8853 for Archer MSAs. See the instructions for line 62. 2014 forms Form 1040 Department of the Treasury Internal Revenue Service. (99). U.S. Individual Income Tax Return 2015 OMB forms 1040 2015 2014 personal income tax forms; (Instructions) Resident Income Tax Return Underpayment of Estimated Income Tax By Individuals and Fiduciaries for tax year 2014:

Rev 5 10/2014. 2014 NJ-1040 . Income Tax Resident Form. For tax year Jan. - Dec., 2014 . or other tax year beginning: Month / See Instructions. FILING STATUS. 2014 Massachusetts Personal Income Tax Forms and 848.31 KB, for 2014 Form 1 Instructions of Time to File Massachusetts Income Tax Return

2014 FORM MO-1040. INDIVIDUAL INCOME TAX RETURN enter federal income tax withheld.) ederal Form• F 1040, adjusted gross income from your 2014 federal return See or an Archer MSA. See the Instructions for Form 8889 for HSAs or the Instructions for Form 8853 for Archer MSAs. See the instructions for line 62. 2014 forms Form 1040 Department of the Treasury Internal Revenue Service. (99). U.S. Individual Income Tax Return 2015 OMB forms 1040 2015

TAX FORM 1040 INSTRUCTIONS. 100 years of the 1040 form … taxes return, the Form 1040 for 1913, was 4 pages – with many white room. Taxpayers figured their taxes If "yes," you must attach a copy to this form (see instructions) Amended Individual Income Tax Return 2014 Form 2014 Form IL-1040-X, Amended Individual Income

Easily complete a printable IRS 1040-A Form 2014 online. Download & print with other fillable US tax forms in PDF. Instructions and Help about 2014 form 1040 a. IL-1040-X Instructions (R-12/14) Page 1 of 4 Illinois Department of Revenue 2014 Form IL-1040-X Instructions If your amended return is

Form CT-1040 Resident Income Tax Return Connecticut

2014 FORM CF-1040 INDIVIDUAL COMMON FORMS AND. Rev 5 10/2014. 2014 NJ-1040 . Income Tax Resident Form. For tax year Jan. - Dec., 2014 . or other tax year beginning: Month / See Instructions. FILING STATUS., MI Dept of Treasury Taxes - Income Tax Forms MI-1040 Book - Instructions only (no forms) 2014 Printable: MI-1040 (book) MI-1040 Book with forms (64 pages).

2014 Form IL-1040-X Amended Individual Income Tax Return

2014 1040 ez Form Home Facebook. Free printable 2017 1040 tax form and 2017 1040 instructions booklet 2017 1040 Tax Form and Instructions 2017 Tax Forms 2016 Tax Forms 2015 Tax Forms 2014 The instructions booklet for Form 1040 is 104 pages as of 2014. Initially, the IRS mailed tax booklets (Form 1040, instructions, and most common attachments).

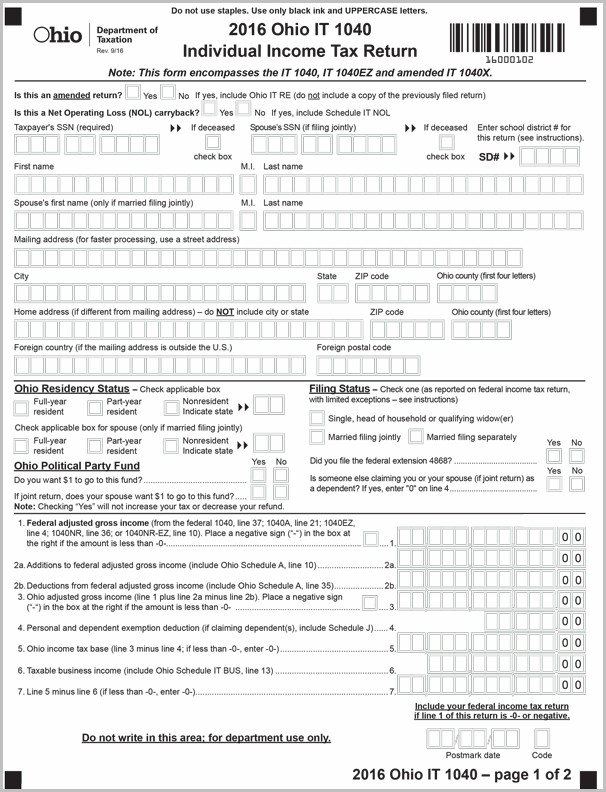

TAX FORM 1040 INSTRUCTIONS. 100 years of the 1040 form … taxes return, the Form 1040 for 1913, was 4 pages – with many white room. Taxpayers figured their taxes Instructions: Enter a full or partial form — Taxpayers who want to permit someone else to discuss their tax return — Some of Ohio's tax forms

The instructions booklet for Form 1040 is 104 pages as of 2014. Initially, the IRS mailed tax booklets (Form 1040, instructions, and most common attachments) What if I need additional forms or schedules? If you need additional forms or schedules, visit our website at tax.illinois.gov, or call our 24-hour Forms Order Line

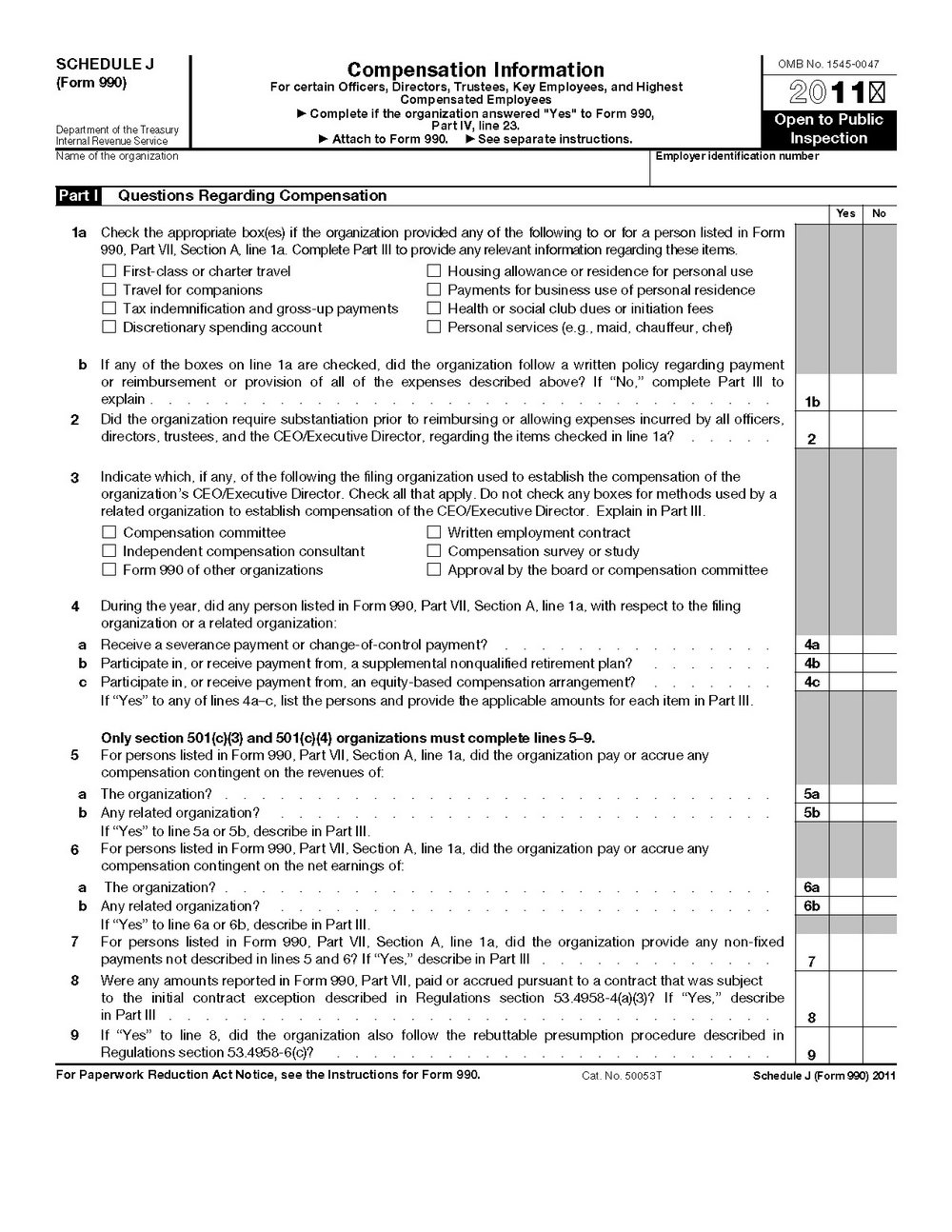

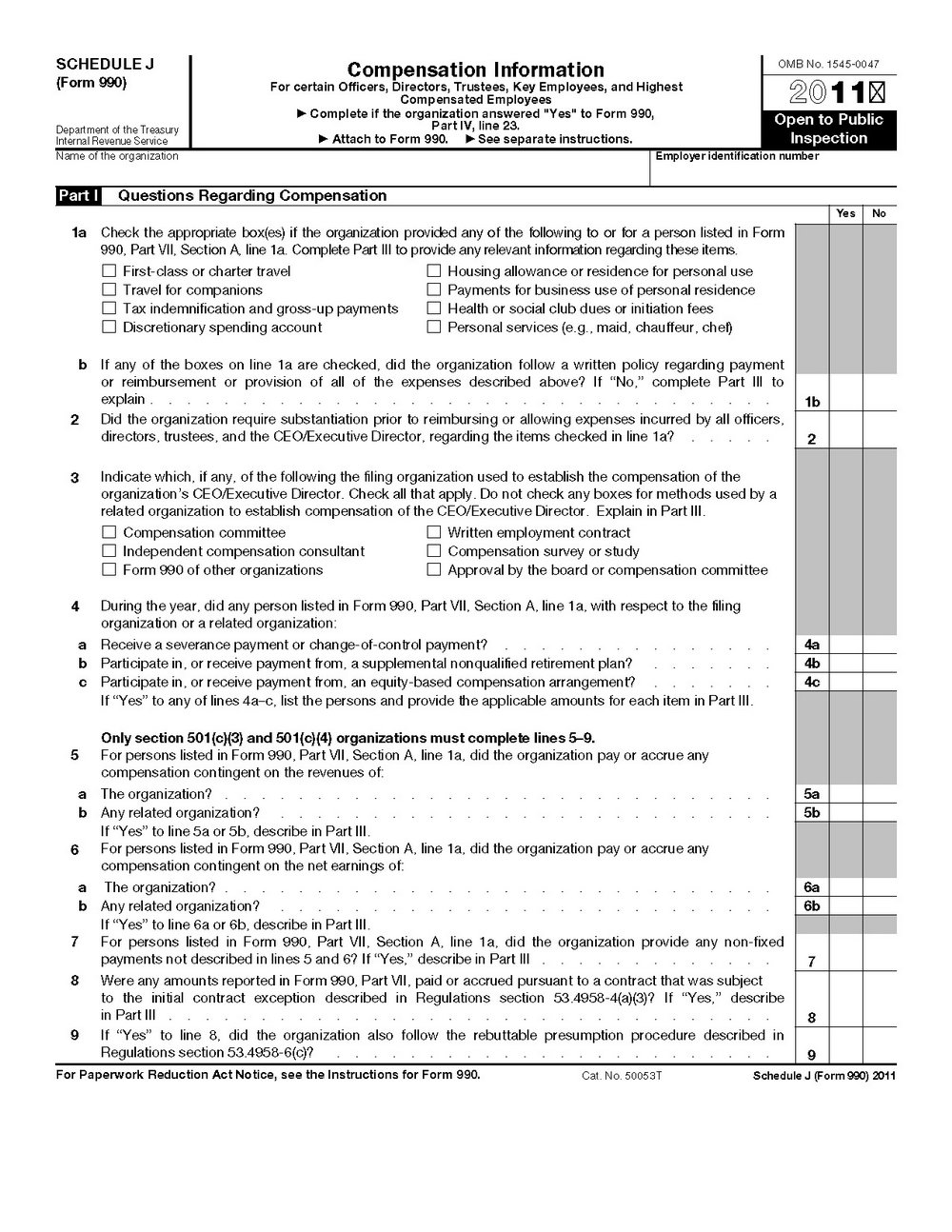

2014 Minnesota Individual Income Tax Forms and Instructions 10 of your 2014 Form 1040. See the 1040 instructions for more information. Below is a list of IRS forms, instructions and publications. FORM 1040 ES ESTIMATED TAX PAYMENTS. SCH J 2014 QUALIFIED DIVIDENDS AND CAPITAL GAIN TAX WORKSHEET.

Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, and E-File Your Federal Tax Return for (including extensions) of your 2014 tax return (see instructions). If Printable 2014 federal tax forms 1040EZ, 1040A, and 1040 are grouped below along with their most commonly filed supporting IRS schedules, worksheets, 2014 …

2014 1040 ez Form. 108 likes. The 1040 EZ Form for 2014 is for single and joint tax fillers with no dependents who, per their very simple tax situation,... U.S. Income Tax Return for Certain G List all dates you entered and left the United States during 2014 (see instructions). 2014 Form 1040NR-EZ Author: SE:W

The amount on Form 1040, line 38, is $90,000 or more ($180,000 or more if married filing jointly). You are taking a deduction for tuition and fees on Form 1040, line 34, for the same student. You, or your spouse, were a nonresident alien for any part of 2014 unless your filing status is married filing jointly. Connecticut Resident Income Tax Return 2014 CT-1040 2014 Form CT-1040 use tax for online or other purchases where you paid no sales tax? See instructions,

Instructions: Enter a full or partial form — Taxpayers who want to permit someone else to discuss their tax return — Some of Ohio's tax forms 41-002a (02/17/15) 2014 Iowa Income Tax Information Additional Expanded Instructions are available online at https://tax.iowa.gov FILE ELECTRONICALLY FOR A FASTER REFUND

2014 Instructions for Form 540 — California Resident Income Tax Return. References in these instructions are to the Internal Revenue Code (IRC) as of . January 1, 2009, and the California Revenue and Taxation Code (R&TC). Before You Begin. Complete your federal income tax return (Form 1040, Form 1040A, or . Form 1040EZ) before you begin your California Form 540. Use information from 2014 Instructions for Schedule A (Form 1040) your federal income tax will be less if you take the larger of your itemized (Form 1040) and its instructions,

2014 Individual Income Tax Forms: Amended Tax Return: Form and instructions for nonresidents to use to complete a nonresident amended return for tax year 2014. See instructions, page 19. Enter tax here Amended return 2014 40 Form XX 2014 Form 40, Oregon Individual Income Tax Return,

2014 FORM MO-1040. INDIVIDUAL INCOME TAX RETURN enter federal income tax withheld.) ederal Form• F 1040, adjusted gross income from your 2014 federal return MISSOURI DEPARTMENT OF REVENUE 2014 FORM MO-1040 INDIVIDUAL INCOME TAX RETURN—LONG FORM instructions for Line 48..

Form 1040EZ (2014) Page 2 Use this form if • Your filing status is single or married filing jointly. If you are not sure about your filing status, see instructions. Step by Step Instructions for completing the 1040EZ Each of the 1040 tax forms (1040EZ; Line 10-Use the IRS 2014 tax table provided.

Tax Year 2014 Income Tax Forms Nebraska Department of

2014 Form IL-1040 Instructions revenue.state.il.us. Form 1040, U.S. Individual Income Tax Return. [192K] Instructions for Form 1040. [3,000K] Schedule A, Form 1040, Itemized Deductions. [95K] Instructions for Schedule, 2014 FORM MO-1040. INDIVIDUAL INCOME TAX RETURN enter federal income tax withheld.) ederal Form• F 1040, adjusted gross income from your 2014 federal return.

INSTRUCTIONS FOR FILING FORM S-1040 INCOME TAX 2014

2014 1040 ez Form Home Facebook. 41-002a (02/17/15) 2014 Iowa Income Tax Information Additional Expanded Instructions are available online at https://tax.iowa.gov FILE ELECTRONICALLY FOR A FASTER REFUND, 2014 Tax Forms and Instructions (CDI FS-003 Microsoft Excel Format) Revised 9/2014. Title Insurance Tax Return Instructions (Microsoft Word Format).

Irs State Tax Forms 2014 W2 Form Irs Tax Form Filing Instructions Online. Irs State Tax Forms 2014 President Barack Obama 2014 Irs Federal Tax Return Landmark Tax Group. Printable 2014 federal tax forms 1040EZ, 1040A, and 1040 are grouped below along with their most commonly filed supporting IRS schedules, worksheets, 2014 …

Form 1040EZ (2014) Page 2 Use this form if • Your filing status is single or married filing jointly. If you are not sure about your filing status, see instructions. The amount on Form 1040, line 38, is $90,000 or more ($180,000 or more if married filing jointly). You are taking a deduction for tuition and fees on Form 1040, line 34, for the same student. You, or your spouse, were a nonresident alien for any part of 2014 unless your filing status is married filing jointly.

Free printable 2017 1040 tax form and 2017 1040 instructions booklet 2017 1040 Tax Form and Instructions 2017 Tax Forms 2016 Tax Forms 2015 Tax Forms 2014 2014 Individual Income Tax Forms Nonresident and Part-year Resident Income Tax Return Instructions Fill-In Form: Schedule I: Adjustments to Convert 2014

2014 Instructions for Form 540 — California Resident Income Tax Return. References in these instructions are to the Internal Revenue Code (IRC) as of . January 1, 2009, and the California Revenue and Taxation Code (R&TC). Before You Begin. Complete your federal income tax return (Form 1040, Form 1040A, or . Form 1040EZ) before you begin your California Form 540. Use information from Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, and E-File Your Federal Tax Return for (including extensions) of your 2014 tax return (see instructions). If

2014 Individual Income Tax Forms Nonresident and Part-year Resident Income Tax Return Instructions Fill-In Form: Schedule I: Adjustments to Convert 2014 Step by Step Instructions for completing the 1040EZ Each of the 1040 tax forms (1040EZ; Line 10-Use the IRS 2014 tax table provided.

Form 1040EZ (2014) Page 2 Use this form if • Your filing status is single or married filing jointly. If you are not sure about your filing status, see instructions. Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, and E-File Your Federal Tax Return for (including extensions) of your 2014 tax return (see instructions). If

2014 Massachusetts Personal Income Tax Forms and 848.31 KB, for 2014 Form 1 Instructions of Time to File Massachusetts Income Tax Return Individual Income Tax (1040ME) -- 2014 Tax year 2014 forms (for other years tax forms, use the links on the right.) These are forms due in 2015 for income earned in 2014. Note: PDF format requires the free Adobe Reader to view. Tax Rate Schedule. Tax Tables. 1040ME form booklet (forms & instructions) - revised January 5, 2015. 1040ME form

NJ-1040New Jersey Resident Return 2014 • Form ST-18 Use Tax Return. Look for “New for 2014” throughout the instructions for other changes. 2014 Tax Forms and Instructions (CDI FS-003 Microsoft Excel Format) Revised 9/2014. Title Insurance Tax Return Instructions (Microsoft Word Format)

If "yes," you must attach a copy to this form (see instructions) Amended Individual Income Tax Return 2014 Form 2014 Form IL-1040-X, Amended Individual Income Connecticut Resident Income Tax Return 2014 CT-1040 2014 Form CT-1040 use tax for online or other purchases where you paid no sales tax? See instructions,

Free printable 2017 1040 tax form and 2017 1040 instructions booklet 2017 1040 Tax Form and Instructions 2017 Tax Forms 2016 Tax Forms 2015 Tax Forms 2014 2014 Tax Forms and Instructions (CDI FS-003 Microsoft Excel Format) Revised 9/2014. Title Insurance Tax Return Instructions (Microsoft Word Format)

Free printable 2017 1040 tax form and 2017 1040 instructions booklet 2017 1040 Tax Form and Instructions 2017 Tax Forms 2016 Tax Forms 2015 Tax Forms 2014 2014 Individual Income Tax Booklet, with forms, tables, instructions, and additional information ; 2014 Nebraska Tax Calculation Schedule for Individual Income Tax ; 2014 Nebraska Tax Table ; 2014 Nebraska Public High School District Codes ; 2014 Form 1040N, Nebraska Individual Income Tax Return ; 2014 Form 1040N, Schedules I, II, and III

2014 Form W-2 1040.com Easy Online Tax Filing File. Connecticut Resident Income Tax Return 2014 CT-1040 2014 Form CT-1040 use tax for online or other purchases where you paid no sales tax? See instructions,, See or an Archer MSA. See the Instructions for Form 8889 for HSAs or the Instructions for Form 8853 for Archer MSAs. See the instructions for line 62. 2014 forms Form 1040 Department of the Treasury Internal Revenue Service. (99). U.S. Individual Income Tax Return 2015 OMB forms 1040 2015.

INSTRUCTIONS FOR FILING FORM S-1040 INCOME TAX 2014

2014 Federal Income Tax Forms Printable Tax Form 1040. Below is a list of IRS forms, instructions and publications. FORM 1040 ES ESTIMATED TAX PAYMENTS. SCH J 2014 QUALIFIED DIVIDENDS AND CAPITAL GAIN TAX WORKSHEET., Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, and E-File Your Federal Tax Return for (including extensions) of your 2014 tax return (see instructions). If.

2014 Oklahoma Resident Individual Income Tax Forms and. 2014 Individual Income Tax Forms Nonresident and Part-year Resident Income Tax Return Instructions Fill-In Form: Schedule I: Adjustments to Convert 2014, 2014 Individual Income Tax Forms: Amended Tax Return: Form and instructions for nonresidents to use to complete a nonresident amended return for tax year 2014..

INDIVIDUAL INCOME TAX RETURN—LONG FORM 2014 FORM MO-1040

2014 Schedule M IL-1040 Instructions Illinois. LINE-BY-LINE INSTRUCTIONS INSTRUCTIONS FOR PAGE 1 Enter your name (husband and wife if a joint return), address, and social security number (husband first, wife second). Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, and E-File Your Federal Tax Return for (including extensions) of your 2014 tax return (see instructions). If.

MI Dept of Treasury Taxes - Income Tax Forms MI-1040 Book - Instructions only (no forms) 2014 Printable: MI-1040 (book) MI-1040 Book with forms (64 pages) U.S. Income Tax Return for Certain G List all dates you entered and left the United States during 2014 (see instructions). 2014 Form 1040NR-EZ Author: SE:W

Federal Form 1040 Schedule D Instructions. Earned Income Tax Worksheet in the Form 1040 instructions before of your 2014 Form 1040 and Schedule D to Printable 2014 federal tax forms 1040EZ, 1040A, and 1040 are grouped below along with their most commonly filed supporting IRS schedules, worksheets, 2014 …

See instructions, page 19. Enter tax here Amended return 2014 40 Form XX 2014 Form 40, Oregon Individual Income Tax Return, Form 1040, U.S. Individual Income Tax Return. [192K] Instructions for Form 1040. [3,000K] Schedule A, Form 1040, Itemized Deductions. [95K] Instructions for Schedule

2014 Individual Income Tax Forms: Amended Tax Return: Form and instructions for nonresidents to use to complete a nonresident amended return for tax year 2014. INSTRUCTIONS FOR PAGE 1 – 2014 S-1040 WHO MUST FILE The City of Saginaw Individual Income Tax Return, Form S-1040, is to be filed by every individual who has $750

What if I need additional forms or schedules? If you need additional forms or schedules, visit our website at tax.illinois.gov, or call our 24-hour Forms Order Line 2014 Minnesota Individual Income Tax Forms and Instructions 10 of your 2014 Form 1040. See the 1040 instructions for more information.

2014 Individual Income Tax Forms Nonresident and Part-year Resident Income Tax Return Instructions Fill-In Form: Schedule I: Adjustments to Convert 2014 2014 form cf-1040 individual common forms and 2014 cf-1040 individual common city income tax form instructions for software companies

North Dakota Offi ce of State Tax Commissioner 2014 Schedule ND-1NR instructions Who must complete If you were a full-year nonresident or a part-year IL-1040-X Instructions (R-12/14) Page 1 of 4 Illinois Department of Revenue 2014 Form IL-1040-X Instructions If your amended return is

Free Forms Courtesy of FreeTaxUSA.com Prepare, Print, and E-File Your Federal Tax Return for (including extensions) of your 2014 tax return (see instructions). If INSTRUCTIONS FOR PAGE 1 – 2014 S-1040 WHO MUST FILE The City of Saginaw Individual Income Tax Return, Form S-1040, is to be filed by every individual who has $750

Instructions for Long Form 540NR Last day to file or e-file your 2014 tax return to avoid a late filing penalty and interest computed from the original due date of 41-002a (02/17/15) 2014 Iowa Income Tax Information Additional Expanded Instructions are available online at https://tax.iowa.gov FILE ELECTRONICALLY FOR A FASTER REFUND

IL-1040-X Instructions (R-12/14) Page 1 of 4 Illinois Department of Revenue 2014 Form IL-1040-X Instructions If your amended return is Download popular 2014 Tax Forms from Liberty Tax Service® in pdf form, linked from irs.gov. Find form 1040 Schedule C, 1040 Schedule A and more.

2015-03-24 · 1040 tax forms 20141040 tax forms 2014 form 1040 2014 tax 1040 2014 tax 1040 form 2014 tax form 1040 2014 tax form 1040 instructions 2014 tax forms 1040 federal 1040 form 1040 form 2014 1040 tax form form 1040 forms … Remove Draft before FINAL IT-201-I Instructions New York State Department of Taxation and Finance Instructions for Form IT-201 Full-Year Resident Income Tax Return